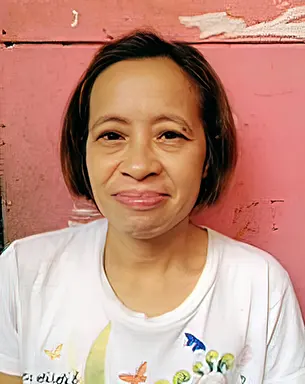

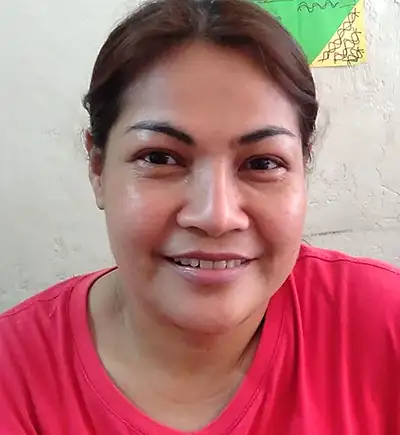

Microfinance: Meet Mary Ann

July, 2021Mary Ann, 45, has been running a successful food business and retail store in Marikina for over eight years. Her income has supported her three children through school, with two now pursuing tertiary education at the University of Santo Tomas in Manila.

In October 2020, seeking to expand her menu, Mary Ann joined Grameen Pilipinas Microfinance Inc. (GPMI) and secured a ₱22,500 (AU$586) loan to purchase an industrial stainless steel griddle. This allowed her to add fresh fried chicken and hamburgers, attracting more customers and growing her business.

Just a month later, Typhoon Ulysses caused severe flooding in her community, submerging the Marikina River and destroying homes, livelihoods, and infrastructure. Mary Ann’s store was heavily affected, and she required support to rebuild. GPMI provided a six-week moratorium on loan repayments, giving her the breathing room to restart operations.

Mary Ann’s story highlights the resilience, determination, and adaptability of microfinance borrowers, demonstrating how access to responsible loans can empower individuals to overcome extraordinary challenges and secure a stable livelihood.

“Even when the floods washed away everything, I knew I had to keep going. With the support of GPMI, I rebuilt my business and continue to provide for my family.”

– Mary Ann

Case location