Green microfinance

Empowering low-income communities through inclusive microfinance and a transition to sustainable livelihoods

Background

In 2014, Dana Asia and its partners established the now Grameen Pilipinas Microfinance Inc. (GPMI), a registered non-profit microfinance institution that provides financial services to underserved populations in the Philippines.

Through our partnership with GPMI, we support the development and delivery of inclusive loan products that enable low-income individuals, especially women, to build small businesses, support their families, and improve their long-term resilience.

Transitioning towards green microfinance

Responding to the need to advocate for the environment in the face of climate change, we are jointly developing and implementing green microfinance loan products that support small-scale, environmentally responsible businesses, helping low-income women entrepreneurs build sustainable livelihoods while protecting the planet.

Impact highlights

Why this matters

Supports these UN Sustainable Development Goals

Support this work

AU$1,000 can support 5 eco microenterprises to launch environmentally-conscious businesses with microfinance.

The model in practice

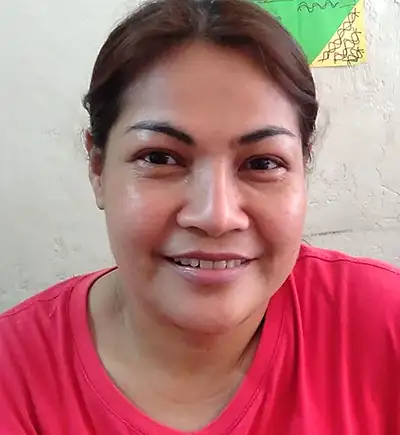

Meet some of the entrepreneurs whose businesses have been transformed with the help of micrfinance. These case studies showcase real-world success, resilience, and the positive ripple effect of sustainable social impact.